Part Four: Why Do I Need a Small Business CFO Advisor?

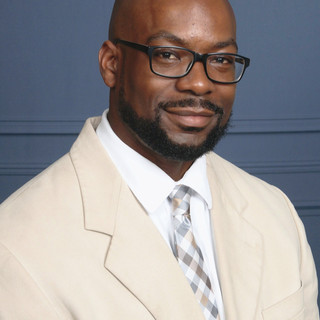

- Pierre Pinkerton

- Jul 31, 2024

- 4 min read

"Our Mission at Guiding Light CFO is to eradicate small business failure by offering expert financial strategies that help your business thrive."

Alright, alright, alright (still channeling my inner McConaughey)! Let's dive into Part Four of our journey. This chapter takes us to my one and a half years as a business credit analyst—a time filled with numbers, negotiations, and a whole lot of learning. If you're wondering what a business credit analyst does, think of it as the financial equivalent of a detective, but with less trench coat and more spreadsheets. My role? Underwriting business loans across various sectors, from commercial real estate to private wealth management, and beyond.

The World of Underwriting: A Diverse Landscape

In those eighteen months, I had the privilege of diving deep into several key areas: commercial real estate (think development and refinancing), private wealth management (doctors, local governments, high net worth individuals, and family firms), and commercial and industrial entities (covering everything from working capital to SBA loans). Each sector had its unique challenges and opportunities, requiring a blend of critical and creative thinking.

For instance, underwriting a commercial real estate loan wasn’t just about evaluating property values and projected income. It was about understanding the vision of the project—what it could bring to the community and how it aligned with market trends. Similarly, when dealing with private wealth and investment management, it wasn’t just numbers on a page. It was about building relationships, understanding the nuances of family dynamics, and advising on investments that would secure futures.

Lessons in Critical and Creative Thinking

One of the most valuable skills I honed during this time was the art of critical and creative thinking. Every loan application was a puzzle, with pieces ranging from financial statements to market analyses. It was my job to fit them together in a way that made sense for both the lender and the borrower. This required a keen eye for detail and the ability to think outside the box.

For example, there were times when a straightforward approach wouldn’t suffice. Perhaps the financials didn’t quite add up, but there was a compelling story behind the numbers—a promising start-up with a unique product, or a seasoned business looking to pivot in a new direction. In these cases, I had to dig deeper, ask the right questions, and sometimes, creatively structure deals that balanced risk and reward.

Mastering Generative Writing and Interpersonal Skills

Beyond numbers, this role also demanded strong generative writing skills. Crafting a comprehensive credit memo was more than just listing out facts and figures. It was about telling a story—presenting the client's vision, the challenges they faced, and the potential they held. These memos were often the bridge between the client’s world and the underwriters, making clarity and precision crucial.

Interpersonal skills were equally important. Whether it was verbal or non-verbal communication, tactfulness and professionalism were key. Meetings, whether internal or client-facing, required a delicate balance of assertiveness and empathy. I learned how to navigate difficult conversations, whether it was questioning a client's financial decisions or discussing risk factors with senior management.

Dressing the Part and Professional Presence

On a more personal note, this job taught me the importance of dressing properly and maintaining a professional presence. It might sound trivial, but the way you present yourself can significantly impact how you're perceived. I quickly realized that a well-fitted suit and polished shoes were not just about looking good; they were about conveying confidence and competence.

This extended to meetings, where understanding how to deeply impact the conversation was crucial. Whether it was a boardroom full of executives or a small team meeting, I learned to read the room, gauge the mood, and adjust my approach accordingly. It was about finding that sweet spot where everyone felt heard, respected, and part of a mutually beneficial relationship.

Creating Mutually Beneficial Relationships

Speaking of relationships, perhaps the most significant lesson from this experience was understanding the importance of creating mutually beneficial outcomes. It wasn’t just about closing deals; it was about building trust and fostering long-term partnerships. This meant being transparent about potential risks, celebrating successes, and always keeping the client’s best interests at heart.

Bringing It All Together

So, why does all this matter for a Small Business CFO Advisor? Because the skills and insights I gained during this period are directly applicable to helping small business owners today. From understanding the intricacies of various industries to mastering the art of negotiation and communication, these experiences have equipped me with a comprehensive toolkit for advising clients.

As we wrap up Part Four, remember this: a Small Business CFO Advisor isn’t just about crunching numbers. It's about being a partner, a guide, and sometimes, a confidant. It's about using critical and creative thinking to navigate challenges, and it's about creating relationships that stand the test of time. So, whether you're looking to expand your business, secure financing, or simply need a fresh perspective, remember that every experience, every lesson learned, is a stepping stone to a brighter future.

Stay tuned for more insights and stories as we continue this journey. Until next time, keep pushing forward and remember—success is a journey, not a destination.

Are You a Small Business Owner that's Experiencing Financial Frustration in Your Business and You're Feeling Stuck?

No Need to Be Stuck Any Longer... Book An Appointment and Let's Get Moving Again!!!

Comments